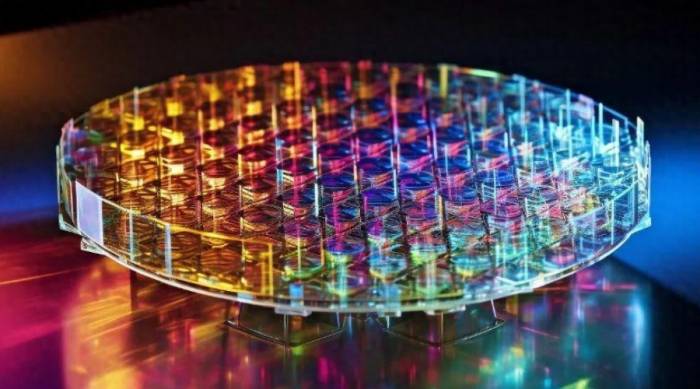

TSMC's 3nm process technology is very popular.

TSMC's 3nm process technology accounted for 15% of the company's revenue in the fourth quarter of 2023. At that time, only one of TSMC's customers was using it, and that was Apple. However, a report from ICSmart states that as more customers adopt this process, the 3nm process node will account for a larger share of TSMC's revenue.

The report states that TSMC's N3 series nodes (including N3B and N3E) will account for over 20% of the wafer foundry's revenue in 2024. Currently, Apple exclusively uses TSMC's N3B to manufacture the A17 Pro system-on-chip (SoC) for smartphones, as well as the M3 series processors for iMac desktops and MacBook laptops. Later this year, AMD and Intel are expected to adopt TSMC's N3E and N3B in their upcoming processors, so it is understandable that 3nm will account for a higher proportion of TSMC's revenue.

AMD is preparing to launch new processors based on the Zen 5 architecture later this year, which will use 3nm and 4nm process technologies. Apparently, the platform codenamed Nirvana will also use TSMC's 3nm technology and is expected to be released in the second half of this year.

Reports suggest that Apple's new iPhone 16 series will be equipped with the A18 series processors, and the upcoming Mac PC M4 series processors will also be produced using TSMC's 3nm technology. ICSmart states that production of these two major chips will begin in the second quarter of this year, indicating that Apple continues to rely on TSMC's N3 series processes.

Advertisement

Intel is also expected to utilize TSMC's 3nm process in its Lunar Lake MX SoC and plans to start mass production in the second quarter. The report points out that this marks the first time Intel has commissioned TSMC to provide a full range of chips for its mainstream consumer platform. This collaboration highlights the increasing role TSMC is playing in serving Intel, who also happens to be a competitor of the company in the wafer foundry market.

With three major customers using TSMC's 3nm series process technology, this node will account for a larger proportion of TSMC's revenue this year. It is expected that by 2025, more companies will adopt TSMC's N3 process, including the performance-enhanced N3P, and the report shows that by 2025, 3nm will account for over 30% of TSMC's earnings.TSMC Becomes the World's Most Profitable Semiconductor Manufacturer

TSMC's financial report for 2023 shows that the company's annual revenue was $69.298 billion, with New Taiwan Dollar (NTD) revenue reaching 2,161.74 billion, a year-on-year decrease of 4.5%, but better than expected. The gross margin was 54.4%, down 5.2% year-on-year, the operating profit margin was 42.6%, down 6.9% year-on-year, and the net profit after taxes was $31.389 billion, approximately NTD 979.171 billion, a 14.4% decrease year-on-year, with earnings per share at NTD 32.34.

Financial analyst Dan Nystedt tweeted that, based on 2023 revenue, TSMC has become the world's largest semiconductor manufacturer for the first time. The report indicates that TSMC's revenue for 2023 reached $69.3 billion, surpassing Intel's $54.23 billion and Samsung's $50.99 billion.

Associate Professor Shen Rongqin from York University in Canada stated that TSMC, established in 1987, took 36 years to become the world's largest semiconductor manufacturer, not just the largest wafer foundry.

According to TSMC's financial forecast released at the January legal meeting this year, the first quarter's revenue is expected to be between $18 billion and $18.8 billion. Based on an exchange rate of 31.1 New Taiwan Dollars to the US dollar, this is approximately between NTD 559.8 billion and 584.68 billion, a sequential decrease of about 6.3%. The gross margin is estimated to be between 52% and 54%, consistent with the fourth quarter of last year, and the operating margin is expected to be between 40% and 42%.

Looking forward to this year's performance, TSMC President Wei Zhe Jia stated that despite the global economy's uncertainties, which may put pressure on consumer sentiment and market demand, the overall semiconductor industry's value (excluding memory) is expected to grow by 10% this year, with the wafer manufacturing industry expected to grow by about 20%. It is estimated that TSMC's annual dollar revenue could increase by 21% to 25%, driven by demand in AI and high-performance computing (HPC).

From Wei Zhe Jia's judgment, it can be seen that TSMC is focusing this year's revenue on AI and HPC, while the automotive chip foundry business, which previously saved the performance of many semiconductor giants during the semiconductor cycle, was not mentioned.

In terms of revenue structure, the proportion of IoT and automotive business in TSMC's total revenue is also declining. In the fourth quarter of 2023, the automotive business accounted for 5% of TSMC's total revenue, unchanged quarter-on-quarter but down 1 percentage point year-on-year. The proportion of IoT business in the total revenue in the fourth quarter was 5%, down 4 percentage points quarter-on-quarter and 3 percentage points year-on-year.

Counterpoint analysis believes that automotive and industrial applications experienced inventory adjustments in the third quarter of 2023, and the inventory adjustment period is expected to continue until the first quarter of 2024. The challenges TSMC will face in 2024 include slow growth in areas other than AI and HPC, as well as weak demand in the automotive industry.

As for artificial intelligence, it is reported that TSMC is actively increasing its system-on-chip integrated single chip (SoIC) capacity plan, planning to increase its monthly production to 5,000-6,000 units by the end of 2024 to meet the strong future demand for AI and HPC. Currently, AMD and Apple are very interested in TSMC's SoIC products; the former is the first customer of TSMC's SoIC, and the latter plans to use SoIC chips with thermoplastic carbon fiber board composite molding technology, intending to apply it to products such as Mac and iPad.Counterpoint Research's Assistant Director, Brady Wang, analyzes that TSMC's strong growth in 3nm process technology and AI applications makes it a major beneficiary in the AI semiconductor field. The market is expected to see a robust increase in AI applications by 2024, highlighting TSMC's key role in providing advanced 5nm and 3nm technologies to enhance artificial intelligence computing devices, thereby reinforcing its dominant position and the best industry position in this domain.

Comment Box